Bill Gates said that digital payments can transform the lives of poor, and if demonetization helps quicken digitization, the temporary pains may be worth going through. “India is pushing towards digitization in a big way,” he said.

Bill Gates said that demonetisation helps quicken digitisation.

He said the temporary pains caused by digitisation is worth going through. Gates said he is also excited about Swachh Bharat initiative.

Since 2002, when it started operations in India, the foundation has invested $1 billion in India.

November 16, 2016: Gates was referring to the ideas he shared during his lecture on technology for transformation at Niti Ayog. The lecture was attended by Prime Minister Narendra Modi, finance minister Arun Jaitley along with other ministers and top officials.

India as an experimental model:

“India is pushing towards digitization in a big way. The scale of the country means that once India gets there, the amount of digital innovation here will be greater than anywhere else in the world,” Gates said.

He was looking forward to the entry of players such as mobile phone companies and others into the consumer finance market.

Gates believes that India’s culture of technological innovation makes it perfectly poised to develop new digital financial services.

Gates’ support for demonetization was closely tied to his enthusiasm for digital financial inclusion and the growth of a digital economy in India. He highlighted the potential of digital platforms to provide financial services to the poor in a more cost-effective manner than traditional microfinance. He believed that digitization would lead to lower interest rates, reduced transaction costs, and increased savings. He also praised the Aadhaar card scheme and the Pradhan Mantri Jan Dhan Yojana for connecting disadvantaged sections of the population to the banking system. Gates saw the potential for India to become the most digitized economy globally.

Gates’ Interest in Digital Initiatives

However, Gates later appeared to backtrack on his direct endorsement of demonetization. When questioned about his support for the policy, he stated that he had “no opinion about demonetisation” and that he had no prior notice or involvement in the decision. He emphasized his support for digitization but avoided commenting on the government’s specific actions.This shift in stance suggests a reluctance to fully endorse the policy, despite his initial positive comments.

Criticism and Context

Throughout his visit to India, Gates expressed a strong interest in collaborating with the Indian government on various digital initiatives, including e-payments, digital health, digital literacy, and e-agriculture. He met with the Minister of Information Technology, Law and Justice, Ravi Shankar Prasad, to discuss these opportunities. Microsoft, through the Bill and Melinda Gates Foundation, was already providing back-end support to several payment banks in India. Gates was keen on streamlining the digital payments system for economically weaker sections in India.

It’s important to note that the demonetization policy faced significant criticism due to its implementation and the hardships it caused for many Indians. Some economists and analysts questioned the policy’s effectiveness and the government’s preparedness. Critics pointed out the disruption to the cash-based economy, particularly affecting the poor, small businesses, and farmers. The policy’s impact on the informal sector and the potential for increased corruption were also concerns.

The sudden announcement on November 8, 2016, invalidating ₹500 and ₹1,000 banknotes, led to widespread chaos and economic challenges.

In India, widespread anger erupted following the government’s abrupt demonetisation decision to eliminate 500 and 1,000 rupee notes, which aimed to combat undeclared wealth and counterfeiting. Long queues formed outside banks as citizens struggled to exchange the banned currency, with experts like economist Prabhat Patnaik criticizing the lack of a transition period, stating that the move left 85% of currency inoperable.

It’s absurdity on the part of the government to have announced the demonetisation overnight.

PRABHAT PATNAIK, ECONOMIST

“Government could have given a period of time, say six months to a year, to exchange old notes with new ones – but not abruptly.”

The 2016 demonetization in India, while intended to curb black money and promote a cashless economy, caused significant disruption and hardship for many citizens.

- Cash Shortages and Exchange Issues: The immediate fallout of demonetization was a severe cash crunch. People faced difficulties exchanging old notes for new ones, leading to long queues at banks and ATMs. ATMs often ran out of cash, exacerbating the problem. The government initially set limits on the amount of cash that could be exchanged or withdrawn, which further restricted access to funds.

- Disruption of Daily Life and Economic Activity: The cash shortages severely disrupted daily life and economic activity. Millions of people, particularly those in the informal sector, struggled to make everyday purchases. Small farmers were unable to sell their produce, and many businesses faced a standstill.

- Impact on the Informal Economy: The informal sector, which employs a significant portion of the Indian workforce, was hit particularly hard. Transactions in this sector are traditionally cash-based, and the demonetization caused widespread disruption to businesses and supply chains. Many small businesses were forced to shut down.

- Job Losses: The economic disruption led to job losses, especially in the unorganized and informal sectors. It is estimated that 1.5 million jobs were lost.

- Deaths and Human Suffering: There were reports of deaths linked to the rush to exchange cash and the lack of access to medical care due to the unavailability of valid currency.

- Impact on Migrant Workers: Migrant workers, who often rely on cash-based money transfer systems, faced increased difficulties in sending money home.

- Impact on Agriculture: The agriculture sector, heavily reliant on cash transactions, was adversely affected. Farmers faced difficulties purchasing seeds, fertilizers, and pesticides, and the prices of crops plummeted due to decreased demand.

- Increased Tax Compliance (Mixed Results): While the government aimed to increase tax compliance, the results were mixed. There was an increase in the number of income tax returns filed, but it was not a significant increase compared to the previous years. The tax-to-GDP ratio increased due to expanding tax base.

- Digital Payments : There was an immediate jump in digital payments due to the cash shortages. However, after the return of cash, the growth in digital payments was modest.

- Concerns about Fairness: The process was criticized for its fairness, with lower-income groups facing greater difficulties. The super-wealthy class was not significantly affected, leading to speculations about prior knowledge of the move.

- What Happened after India Eliminated Cash. [strategy-business.com/article/What-Happened-after-India-Eliminated-Cash]

- 2016 Indian banknote demonetisation. [en.wikipedia.org/wiki/2016_Indian_banknote_demonetisation]

- Six years after demonetization, cash has roared back in. [qz.com/six-years-after-demonetization-cash-has-roared-back-in-1849756013]

- 2016 Indian banknote demonetisation. [en.wikipedia.org/wiki/2016_Indian_banknote_demonetisation]

- Life after demonetization: How India’s poor are paying the price. [aljazeera.com/economy/2019/6/14/life-after-demonetisation-how-indias-poor-are-paying-the-price]

- Life after demonetization: How India’s poor are paying the price. [aljazeera.com/economy/2019/6/14/life-after-demonetisation-how-indias-poor-are-paying-the-price]

- The economic and political consequences of India’s demonetization. [theigc.org/blogs/economic-and-political-consequences-indias-demonetisation]

- Life after demonetization: How India’s poor are paying the price. [aljazeera.com/economy/2019/6/14/life-after-demonetisation-how-indias-poor-are-paying-the-price]

- Demonetization drive that cost India 1.5m jobs fails to uncover ‘black money’. [theguardian.com/world/2018/aug/30/india-demonetisation-drive-fails-uncover-black-money]

- Demonetization drive that cost India 1.5m jobs fails to uncover ‘black money’. [theguardian.com/world/2018/aug/30/india-demonetisation-drive-fails-uncover-black-money]

- Life after demonetization: How India’s poor are paying the price. [aljazeera.com/economy/2019/6/14/life-after-demonetisation-how-indias-poor-are-paying-the-price]

- 2016 Indian banknote demonetisation. [en.wikipedia.org/wiki/2016_Indian_banknote_demonetisation]

- India’s DEMONetization: An Ethics Analysis. [sevenpillarsinstitute-org.sevenpillarsconsulting.com/indias-demonetization-an-ethics-analysis/]

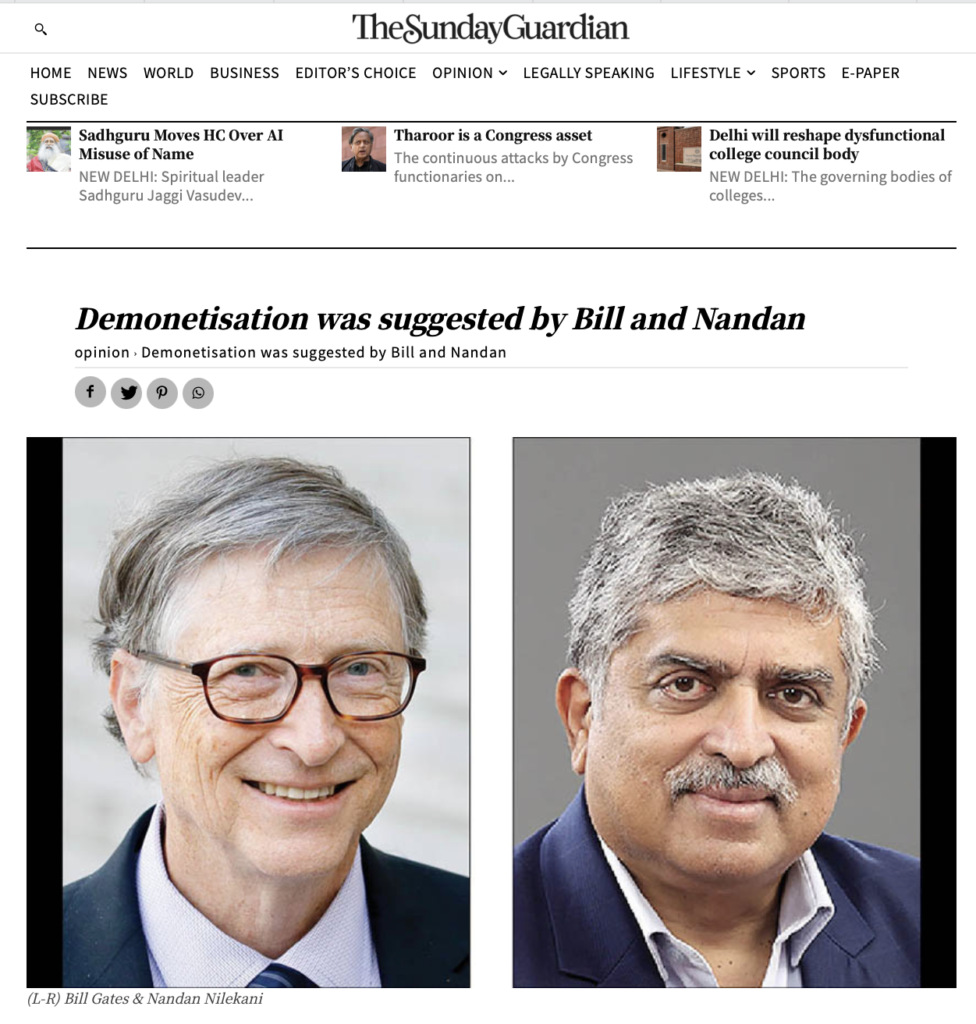

Demonetisation was suggested by Bill and Nandan

The billionaires advocated an exponential increase in cashless transactions and demonetization to the PMO.

Bill Gates and Nandan Nilekani advocated for an increase in cashless transactions and demonetization to the Prime Minister’s Office (PMO). This suggestion was followed by approval from senior officials in the PMO, the Finance & Revenue Secretaries, and the Governor of the Reserve Bank of India. The decision to demonetize 86% of the cash in circulation was made with only four hours notice, followed by a reportedly shoddy implementation

The demonetization was met with mixed reactions, with some central bankers and international commentators initially supporting it. However, the move was also criticized as poorly planned and unfair. The consensus is that demonetization was not the right move to target black money and was unsuccessful. The Reserve Bank of India’s (RBI) 2018 report stated that approximately 99.3% of the demonetized banknotes were deposited in banks, leading analysts to conclude that the effort had failed to remove black money from the economy. The move also resulted in job losses, a decline in wages, and a negative impact on the informal sector.

The proposal for demonetization, advocated by Bill Gates and Nandan Nilekani, had a significant impact on the Indian economy:

- Economic Consequences:

- Several studies have demonstrated a 2% drop in GDP growth attributable to demonetization.

- The billionaire duo has vicarious responsibility for some $52 billion of losses of the $2.6 trillion economy in year 2016-17 alone.

- Demonetisation had a devastating impact on the informal sector, migrant workers, and other disadvantaged sections of society.

- It led to a drying up of investable capital and a tremendous loss of employment, as small and medium enterprises folded due to cash shortages.

- Nandan Nilekani himself acknowledged that demonetization was a defining moment in India’s journey to a less-cash economy.

- Shift to Cashless Economy:

- Nandan Nilekani stated that the bulk of merchant payments should turn cashless to get the economy on the right track.

- He emphasized the role of phone-based and technological infrastructure like the Unified Payment Interface (UPI) in enabling cashless payments.

- Demonetization provided a sharp focus on cashless payments and digitization.

- The move towards a cashless economy was seen as a way to reignite economic growth by removing frictions in purchasing decisions.

- Criticisms and Concerns:

- Critics argued that demonetization did not achieve its stated goals of curbing black money, corruption, or terrorism.

- There were concerns about the impact on the informal economy, with many street vendors and small retailers struggling to adapt to digital payment methods.

- The push for a cashless economy raised privacy concerns, as digital transactions generate vast amounts of data that can be monetized.

- The government’s move towards a cashless society is being made without the necessary safeguards being put in place to regulate such a system and to protect citizens and their data.

- Long-Term Effects:

- Demonetisation was a defining moment in India’s journey to a less-cash economy.

- It accelerated the adoption of digital payment technologies.

- The long-term effects of demonetization are still being evaluated, with ongoing debates about its impact on various sectors of the economy.

Raghuram Rajan’s Stance on Demonetization

Raghuram Rajan, former RBI Governor, has clarified his position on the 2016 demonetization in his book “I Do What I Do.” He stated that he was asked for his views on demonetization by the government in February 2016. He conveyed his concerns orally, believing that the short-term economic costs would likely outweigh any long-term benefits, and suggested potentially better alternatives to achieve the intended goals. He made these views known “in no uncertain terms.”

Concerns and Warnings

Rajan’s account reveals that the RBI was subsequently asked to prepare a note outlining the potential costs and benefits of demonetization, along with alternative approaches. The note also detailed the necessary preparations and the time required for implementation, highlighting the potential consequences of inadequate preparation. Rajan emphasized that the RBI was never asked to make a decision on demonetization during his tenure. The government then established a committee to consider the issues, with the deputy governor in charge of currency attending the meetings.

Economic Impacts of Demonetisation According to Raghuram Rajan

Here’s an analysis of the economic impacts of demonetisation according to Raghuram Rajan based on the provided sources:

Negative Economic Impact

Raghuram Rajan has consistently maintained that demonetisation, the 2016 policy of banning ₹500 and ₹1,000 notes, was not a good idea and that its implementation was poorly planned. He stated that he made this clear to the government at the time.

Impact on Growth

Rajan highlighted several negative economic impacts of demonetisation. He stated that the move had a negative economic impact and that the exercise did not have the direct effect that was sought. He noted that the policy led to people not having currency, not being able to pay, and a plummeting of economic activity, especially in the informal sector. He also expressed concern that many people likely lost their jobs due to demonetisation, although these losses were not well-counted, as they were primarily in the informal sector.

Lack of Planning and Execution

Rajan has stated that demonetisation slowed down India’s economic growth at a time when the world economy was growing. He mentioned that he had seen studies that reaffirmed that the banning of high-value currency notes in late 2016 significantly impacted India’s growth. He noted that India’s growth slowed down in 2017 while the world economy was picking up. He estimated that the cost of demonetisation varied between 1.5-2% of the GDP.

Long-Term Effects and Uncertainties

Rajan criticized the planning and execution of demonetisation. He pointed out that a significant portion of the currency (87.5%) was demonetised, and the government did not ensure that a similar amount of currency was printed and ready for circulation. He called the expectation that people would voluntarily declare and pay taxes on undeclared income a “naive view,” given the Indian context.

While acknowledging that there might be some longer-term impacts, such as increased tax payments, Rajan emphasized that strong evidence was still needed to confirm these benefits. He stated that the positive impacts of demonetisation were in the future, and it was uncertain whether they would be significant.

Rajan also noted that demonetisation, along with the implementation of the Goods and Services Tax (GST), created a “twin blow” that negatively impacted India’s economic growth.

Sudden rise in UPI

If you look at the growth rate in electronic transactions, what we’ve seen is a blip up during the demonetization. But then in many situations of that to the trend growth rate. So it’s not that it has had a permanent upliftment.

The only place, I mean one place I should say, where you see a big change is UPI, Universal Payment Interface. There’s significantly more transactions being done there. Of course, it was a technology which was in its early days (UPI was officially launched in April 2016 for public use) then, but I think there was impetus to improve it in the very short run with the demonetization that has been helpful.

Big Breaking: What is the Trick Behind Banning the 500 Rupee Note? What is the GREAT RESET Trap?

Bill Gates tries QR code payment in SG

Source:TOI,BBC, Qvive, Youtube, Wikipedia

Also Read: