September 30, 2025: President Donald Trump revealed a major deal with the big drug company Pfizer to help lower the cost of prescription medications in the U.S.

TrumpRx, an online platform that bypasses insurance channels, will facilitate consumers’ purchase of medications directly through the deal. The deal is cited as a new development in drug pricing history.

Specific terms of the agreement remain confidential.

“We are proud to join President Trump at the White House to celebrate this landmark agreement that is a win for American patients, a win for American leadership, and a win for Pfizer,” said Albert Bourla.

Before moving on, take a moment to read the articles linked below. Why is transparency a concern?

Pfizer Admits mRNA Jabs Contain ‘Nanobots’ That Permanently Alter DNA

The agreement addresses four specific requests from President Trump’s July 31 letter, ensuring that American patients receive drug prices comparable to those in other developed nations.

The agreement provides Pfizer with a three-year grace period against tariffs under a Section 232 investigation, conditional on further U.S. manufacturing investment. This stability is expected to foster greater industry valuation and investment.

On October 1, 2025, Pfizer’s stock saw a significant rise following the announcement of a new deal between CEO Albert Bourla and President Donald Trump. This agreement aims to reduce U.S. drug prices and mandate a $70 billion investment in domestic manufacturing. Additionally, it includes a three-year tariff exemption for Pfizer, enabling the company to boost its drug production in the U.S. While the agreement is positioned as beneficial for American consumers, critics are raising serious questions regarding its transparency and implications.

Starboard Value, led by Jeff Smith, has launched a proxy fight against Pfizer, questioning CEO Albert Bourla‘s management and investment decisions. Their criticisms, often leaked anonymously to the media, center on the perception that Pfizer’s stock has underperformed during Bourla’s tenure, that he overpaid for acquisitions, and that the company squandered its COVID-19 vaccine profits. While Starboard’s detailed turnaround plan has not been publicly revealed, it is believed to advocate for drastic cost cuts, a strategy reminiscent of former CEO Ian Read’s approach. Read and former CFO Frank D’Amelio initially sided with Starboard but later switched their support to Bourla

Some shareholders have also expressed dissatisfaction with Bourla’s M&A strategy, suggesting that Pfizer should instead focus on returning capital to shareholders through large special dividends or accelerated share repurchases. However, Pfizer’s board, which includes prominent figures like Coca-Cola CEO James Quincey and former FDA Commissioner Scott Gottlieb, has maintained that investing in the business through M&A is crucial for replenishing the R&D pipeline as patents expire.

Main Features of the Initiative

- Direct Consumer Purchases: The TrumpRx platform allows Americans to buy medications directly from Pfizer, which is intended to lower the cost burden on consumers.

- Most-Favored Nation (MFN) Pricing: This pricing model seeks to align U.S. drug costs with those found in other developed countries, utilizing the lowest medication prices as benchmarks.

- Potential Discounts: Trump claims that some medications could experience price reductions of up to 1,000%, although specific drugs and their new prices have not been disclosed.

Economic Context

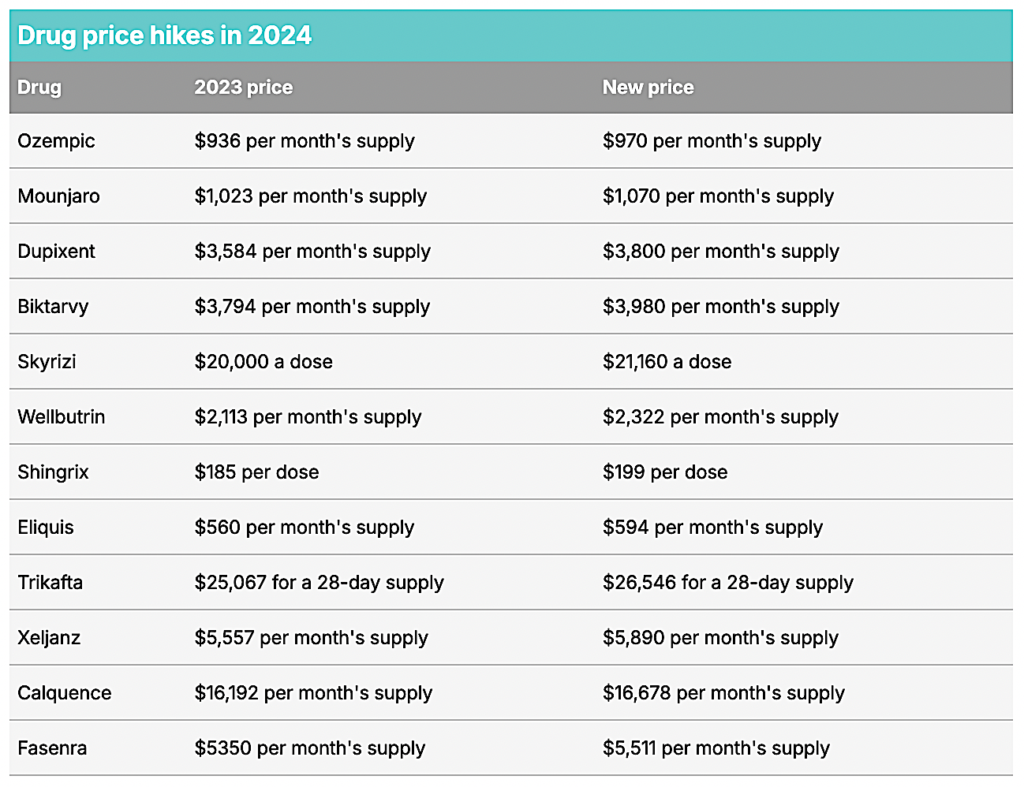

Current statistics show a concerning trend in drug pricing. From January 2022 to January 2023, over 4,200 prescription drugs saw price increases, with an average surge of 15%, equating to an additional $590 per product. Notably, the Department of Health and Human Services (HHS) has documented that a significant percentage of these hikes outpaced inflation rates. A recent analysis indicated that medications such as Jardiance are priced up to five times higher in the U.S. compared to nations like Australia.

Support and Impact

The campaign for this pricing reform is championed by administration officials, including Chris Klomp, senior advisor to the HHS Secretary. Klomp heralded the agreement as a “major win” for affordable healthcare. Furthermore, Pfizer’s CEO, Albert Bourla, stated that the agreement would foster greater focus on innovation in drug development, particularly in cancer therapies and vaccines.

The administration has also announced the imposition of a 100% tariff on branded pharmaceutical products manufactured offshore, aiming to incentivize domestic production. This follows Pfizer’s commitment to invest $70 billion in U.S. manufacturing and research and development.

Potential Challenges

Despite these promising developments, uncertainties loom regarding the accessibility of the lower drug prices for Americans under government insurance programs like Medicare or Medicaid, as well as those with private health coverage.

In parallel, the president revealed plans for future pricing reductions on unspecified medications, including a pill priced at $10 under the MFN model, highlighting ongoing negotiations with other pharmaceutical companies.

President Trump acknowledged potential government shutdowns that could impact the rollout of the TrumpRx site, reiterating that the objective is to create a “fair” pricing system that aligns with global standards.

Calls for Transparency

Beyond internal investment strategies, Pfizer has faced criticism regarding its agreements with the US government. For instance, a deal struck with the Trump administration to lower US drug prices and invest in US manufacturing drew scrutiny.

- Skepticism from Critics: Organizations such as Children’s Health Defense (CHD) have expressed alarm over the confidentiality surrounding the deal’s specific terms. CHD’s CEO, Mary Holland, highlighted that a lack of details undermines the Trump administration’s purported commitment to transparency, particularly given Pfizer’s history of legal infractions regarding drug marketing practices.

- FOIA Requests Filed: In response to the opacity of the agreement, public interest groups, including Public Citizen and the Informed Consent Action Network, have filed Freedom of Information Act (FOIA) requests seeking more information about the deal. These groups argue that without the explicit terms being public, it is difficult for the American public to understand the implications of this collaboration between the government and a pharmaceutical giant.

These organizations raised concerns about the confidentiality of the deal’s terms, Pfizer’s past conduct, and the potential for the agreement to primarily benefit Pfizer rather than the public. Critics argued that the lack of transparency undermined the administration’s commitment to openness and that the deal might not significantly impact drug prices for most Americans, as Pfizer already offered discounts to Medicaid patients and many people have insurance that covers drug costs. The deal also offered Pfizer “certainty and stability” on tariffs and pricing, and potentially a “special status” for expedited drug approvals, which critics viewed as a benefit to the company without clear public advantage.

Can’t believe this happened. Praising the death eater himself Pfizer CEO Albert Bourla in the Oval Office. All to announce that Pfizer will receive $70 Billion from U.S. tax payers to expand Its mRNA empire. pic.twitter.com/EQVLKA1XDk

— Clayton Morris (@ClaytonMorris) October 1, 2025

Main Aspects of the Deal

- Hallmarks of the Agreement: The deal encompasses lower drug prices for U.S. patients, the introduction of a government-operated website (TrumpRX) to facilitate discounted purchasing, and the commitment to sell drugs to Medicaid at reduced rates. According to Bourla, these measures provide Pfizer with “certainty and stability” amidst fluctuating tariff conditions, which he believes will enhance price predictability and support drug innovation in fields like cancer, obesity, and immunology.

- Duration and Impact: The tariff exemption extends for three years, during which Pfizer plans to manufacture drugs domestically, a shift likely aimed at ensuring a robust supply chain within the U.S.

Market Reactions and Analytical Perspectives

- Neutral Financial Impacts: Analysts suggest that despite the significant commitments made by Pfizer, the deal may not drastically alter the company’s financial outlook. It has emerged that many of the discounted drug prices and Medicaid adjustments were already in place before this announcement, potentially diminishing the impact of the new pricing structures.

- Risk of Future Legal and Ethical Issues: Concerns grow that this agreement may set a precedent encouraging other pharmaceutical companies to pursue similar arrangements to obtain favorable pricing terms through government deals, which could provoke a series of lawsuits and market instability for smaller biotech firms.

The newly inked deal between Pfizer and the Trump administration underscores a crucial intersection of health policy, corporate interests, and public trust. While it aims to reduce drug prices and enhance domestic manufacturing, the lack of transparency and past controversies involving Pfizer raise important ethical questions about governmental partnerships with major pharmaceutical players. The reactions from critics and public health advocates indicate a demand for greater accountability, particularly in light of Pfizer’s historical conduct and ongoing debates around the safety and efficacy of its products. As this situation develops, the need for clarity and oversight in the relationship between big pharma and government entities remains a pressing concern for stakeholders in the health sector and the wider public.

And this is who Trump is shaking hands with, doing deals with, licensing his own name to, and holding up as heroes of America: PFIZER! https://t.co/rC1zQ0lOBO

— HealthRanger (@HealthRanger) October 1, 2025

Trump announces drug pricing deal with Pfizer

Ref:

Children’s Health Defense, Insights, Daily Mail, Salt Conference, NBC News

Also Read: