Cash transactions are vital, especially for Unified Payments Interface (UPI) transaction failures. Recognizing cash’s importance is crucial for smooth financial operations.

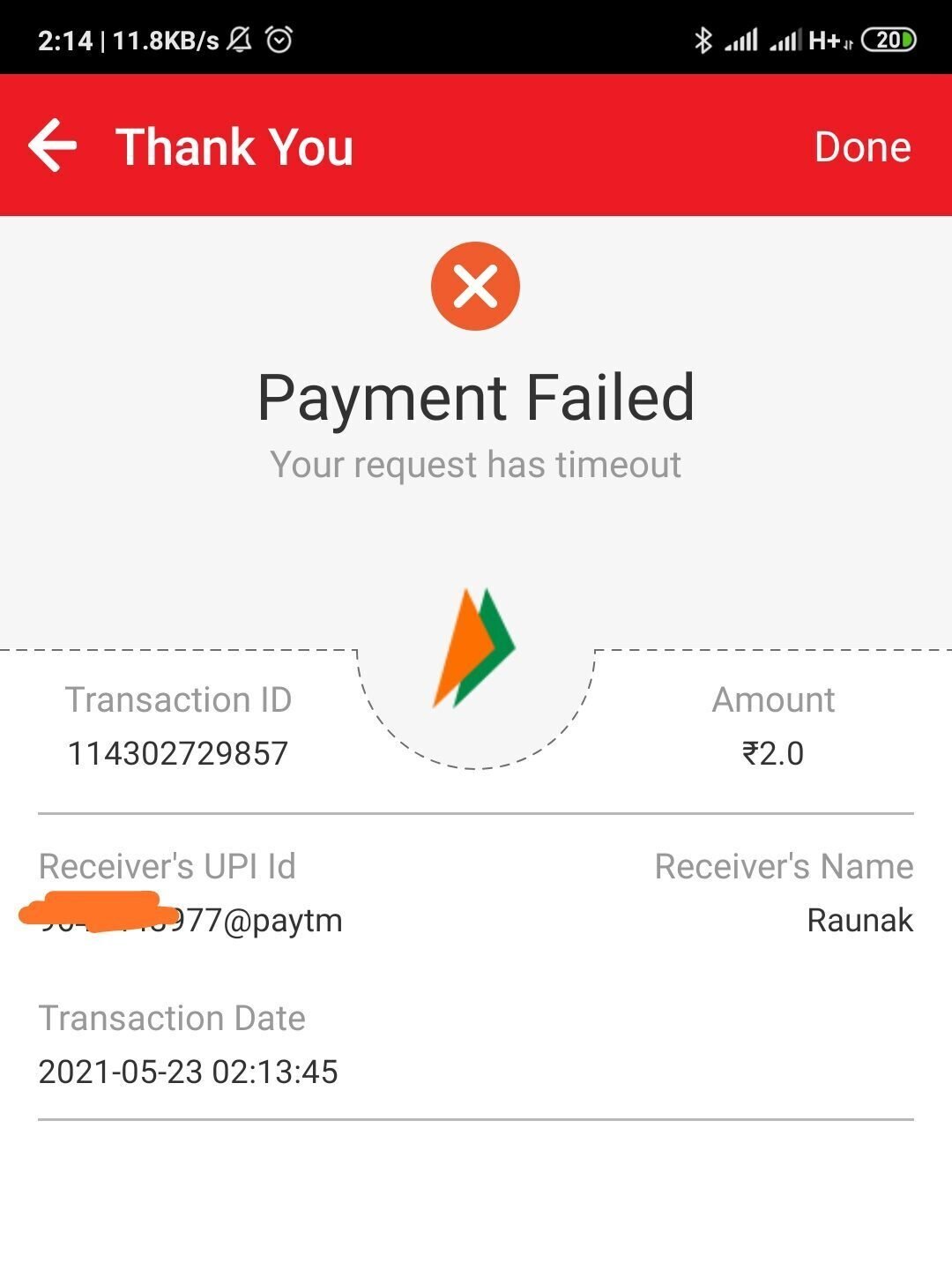

With the rising popularity of digital payments, UPI transactions have become an integral part of our everyday lives. However, they are not without their flaws. UPI transaction failures can occur due to various reasons, such as poor network connectivity, technical glitches, or insufficient funds in the linked bank account. These failures can be frustrating and time-consuming, leading to a loss of confidence in the digital payment system.

Always keep some cash on hand in case UPI or digital transactions hit a snag. It’s never a good idea to rely solely on one method. While UPI transactions are convenient, it’s smart to have other payment options available just in case.

With just a few taps on our smartphones, we can transfer money, pay bills, and make purchases without the hassle of carrying physical cash. However, it is important to remember that technology is not infallible, and there may be instances when UPI or digital transactions hit a snag.

Moreover, cash offers a sense of security and stability during uncertain times. It acts as a buffer against unforeseen circumstances, such as technical glitches or network failures, which can temporarily paralyze digital payment systems. By having cash on hand, businesses can navigate through such challenges and ensure the smooth functioning of their financial operations.

Despite the widespread adoption of UPI transactions, there have been instances where such transactions have encountered failures. This has led to doubts and concerns regarding the reliability of cashless transactions.

As UPI transactions continue to gain traction, it is essential to acknowledge the potential risks associated with transaction failures. When a UPI transaction fails, funds do not get transferred as intended, leading to delays and complications in expected cash inflow. This situation can be particularly detrimental for businesses and individuals who heavily rely on UPI transactions for their financial dealings.

Here are some posts from users:

Yes, this is @HDFC_Bank! Nothing is going with new-age banking. Mobile Banking, UPI, Trading Account… everything is down when you badly need it. The bank makes you frustrated at the merchant when you initiate payment through UPI.

— a common man (@soumyos) February 6, 2024

Please look into it. @RBI @FinMinIndia pic.twitter.com/95pCnswV5U

Digital payments often require individuals to share personal and financial information, which raises concerns about privacy. The collection and storage of vast amounts of user data by payment providers can potentially be misused or compromised, leading to identity theft or unauthorized access to sensitive information.

Over 95,000 UPI fraud cases reported in 2022-23: Centre in Parliament

The Union finance ministry has informed the Parliament that more than 95,000 fraud cases of Unified Payments Interface (UPI) transactions were recorded in the country in 2022-23, an increase from 77,000 cases in 2020-21, and 84,0000 cases in 2021-22.

More than ₹125 crores worth of UPI transactions were completed last year alone, data from the National Payments Corporation of India (NPCI) has revealed, an uptick from the last three years.

The Indian digital payments system also gained global acceptance, with Singapore, the UAE, Mauritius, Nepal and Bhutan being among the countries that have adopted UPI, the ministry said.

The data was revealed in response to a question raised by Rajya Sabha MP Kartikeya Sharma over the increasing cases of digital payments fraud in India.

“UPI applications provide an in-app intimation of a user initiating payment to an unknown beneficiary, the device-binding concept, wherein a user’s mobile number is bound with his mobile device, which makes it nearly impossible for anyone to interject,” Dr Bhagwat Karad, minister of state for finance told the Parliament.

UPI Transactions Failing? “Internal Technical Issue” Says NPCI

UPI transactions failing or not working? Several users on X (formerly Twitter) reported their UPI transactions to be failing since February 5th. This included several major banks such as SBI, HDFC, Central Bank of India, etc.

UPI transactions failing or not working? Several users on X (formerly Twitter) reported their UPI transactions to be failing since February 5th. This included several major banks such as SBI, HDFC, Central Bank of India, etc.

NPCI hasn’t specifically mentioned what this internal technical issue is that is causing several users’ UPI transactions to fail. However, as per complaints shared by users, the bank servers are down.

Banks that are reportedly facing the issue of UPI not working

- Central Bank of India

- HDFC Bank

- Bank of Baroda

- Kotak Mahindra Bank

- SBI

Now that we understand the importance of maintaining cash flow amidst UPI transaction failures, let’s explore the benefits of optimizing cash flow:

The Benefits of Cash Transaction Optimization

- Reliability: Unlike UPI transactions, cash transactions offer a higher level of reliability. With physical currency in hand, there are no external factors that can hinder the completion of a transaction. You can trust that your payment will be successfully made without any unexpected failures.

- Faster Transactions: Cash transactions are often quicker and more efficient compared to digital payments. With no need for internet connectivity or waiting for transaction confirmations, the process becomes significantly faster. This can be particularly beneficial in situations where time is of the essence, such as making small purchases or paying in remote areas with limited connectivity.

- Ease of Use: Cash transactions require minimal technical knowledge or expertise. Anyone can easily understand and engage in cash transactions, regardless of their familiarity with digital payment platforms. This simplicity makes it a viable option for individuals who prefer a straightforward and hassle-free payment method.

- Privacy and Security: Cash transactions provide a heightened sense of privacy and security. Unlike digital payments, which leave a digital trail, cash exchanges require no personal information to be shared. This reduces the risk of potential data breaches or identity thefts, providing peace of mind to individuals concerned about online security.

- Universal Acceptance: Cash transactions are universally accepted, regardless of whether you are in a rural village or a bustling city. Unlike digital payment systems that may require specific technological infrastructure or network coverage, physical currency is always readily accepted. This makes cash optimization ideal for individuals who frequently travel or reside in areas with limited digital payment options.

Final Note: UPI and digital transactions offer convenience and efficiency, it is always wise to have some cash on hand as a backup. Technology can be unpredictable, and there may be instances when digital methods fail or are not accepted. By diversifying your payment options, you can ensure that you are prepared for any situation and can continue to make necessary payments without relying solely on one method.

Source: TOI, HT, Desidime, Zeebiz-Image, Linkedin, KCommunity,

Also Read: