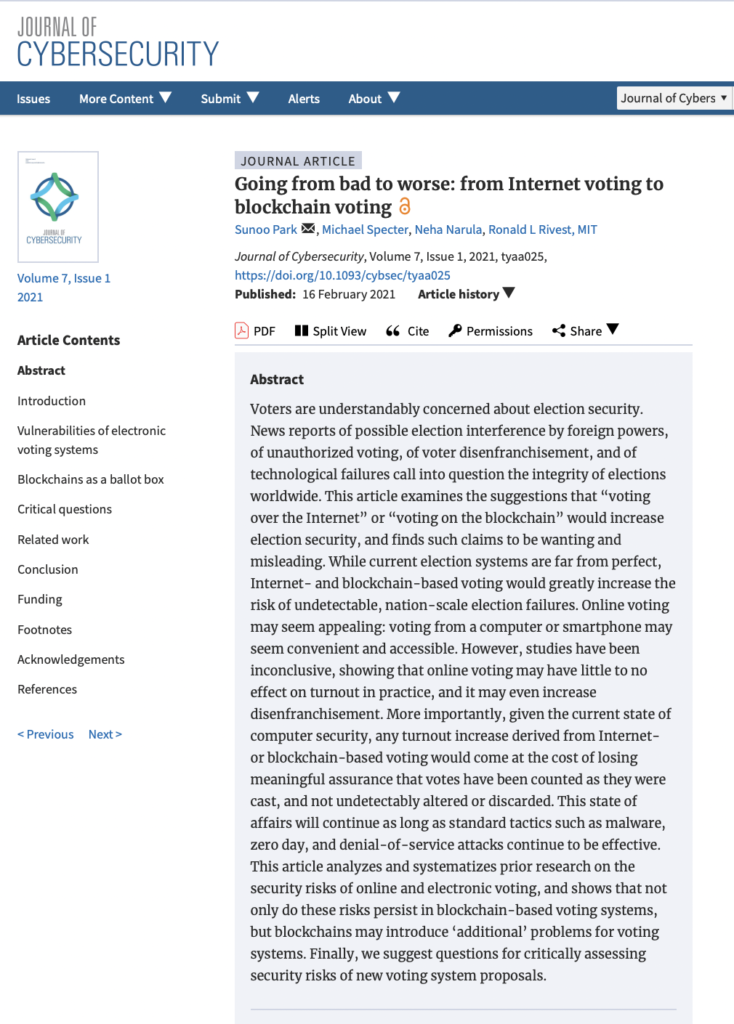

“Election Security Concerns and Blockchain-Based Voting”

• Discusses concerns about election security, including potential foreign interference, unauthorized voting, voter disenfranchisement, and technological failures.

• Criticizes the claims of “voting over the Internet” or “voting on the blockchain” as misleading.

• Highlights that these technologies increase the risk of undetectable, nation-scale election failures.

• Indicates that online voting may have little to no effect on actual turnout and may increase disenfranchisement.

• Highlights the risk of losing assurance that votes are counted as they were cast, and not altered or discarded.

• Analyzes prior research on security risks of online and electronic voting, and suggests questions for critically assessing new voting system proposals.

Massachusetts Institute of Technology (MIT) experts: no, don’t use blockchain to vote

In the middle of a pandemic, it’s not surprising that there have been increasing calls to explore the possibility of conducting elections online. A growing number of tech start-ups have even advocated for using blockchain technology, which they say would boost voter turn-out and improve public trust [a].

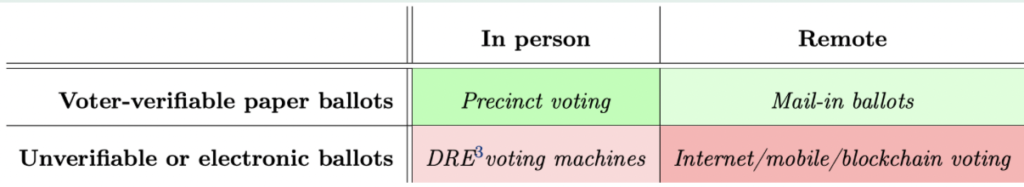

[a] https://www.fastcompany.com/90419485/i-study-blockchain-it-shouldnt-be-used-to-secure-our-electionsBut in a new paper [b] looking at a range of examples, a team of MIT cybersecurity experts have come out strongly against using any form of blockchain-based voting, and said that online voting in general is much more vulnerable to being hacked than in-person or mail-in voting. They say that the physical nature of mail-in ballots make them much less susceptible to large-scale attacks compared to online voting, where exploiting a single vulnerability could impact every ballot at once.

[b] http://people.csail.mit.edu/rivest/pubs/PSNR20.pdfThe team says that blockchain-based approaches are ripe for what they call “serious failures” – situations where election results have been changed in ways that are undetectable, or, even if detected, would be irreparable without running a whole new election.

“While current election systems are far from perfect, blockchain would greatly increase the risk of undetectable, nation-scale election failures,” says MIT professor Ron Rivest, co-creator of RSA public-key encryption and senior author of the new paper. “Any turnout increase would come at the cost of losing meaningful assurance that votes have been counted as they were cast.”

Though blockchain-based apps like Voatz have been deployed in state and county elections, researchers like paper co-author Mike Specter have previously shown that such systems suffer from serious security vulnerabilities [c] enabling attackers to monitor votes being cast and even change or block ballots.

MIT researchers identify security vulnerabilities in voting app

Mobile voting application could allow hackers to alter individual votes and may pose privacy issues for users.

[c] https://news.mit.edu/2020/voting-voatz-app-hack-issues-0213Lead author Sunoo Park says that an essential quality lacking in blockchain systems is “software independence” – that is, the assurance that an undetected change or error in a system’s software cannot cause an undetectable change in the election outcome. Blockchain-based approaches require voters to use software for which a single bug could undetectably change what they see (e.g., showing them that their vote was cast for a certain candidate when it actually wasn’t).

The researchers argue that, at this point in time, only paper ballots allow voters to directly verify that their ballot accurately represents their intended vote.

“If vote-casting is entirely software-based, a malicious system could fool the voter about how the vote was actually recorded,” says Rivest, whose team’s paper was published online this week. “Democracy — and the consent of the governed — cannot be made contingent on whether some software correctly recorded voters’ choices.”

Many proponents of online voting cite the fact that industries like retail and banking have had relative success with online security for decades. But the team expresses two major objections to those parallels.

For one, they say that those systems have higher tolerances for failure that can be more readily accommodated in the case of scenarios like credit card fraud.

“For elections there is no insurance or recourse against a failure of democracy,” Rivest says. “There is no means to ‘make voters whole again’ after a compromised election.”

Secondly, with voting there are important differences in anonymity. With banking you can look at receipts to detect and fix fraudulent purchases. With voting, it’s vital that we *not* be able to prove the way we voted, so that votes cannot be sold or coerced in any way.

Park, Rivest and Specter co-wrote the paper with Neha Narula, director of MIT’s Digital Currency Initiative (DCI) [d]. This project was supported in part by the DCI, the National Science Foundation, the MIT Internet Policy Research Initiative and a Google fellowship

[d] https://dci.mit.edu/Additional Information:

The Gates Foundation Just Launched a Blockchain-Powered Mobile Payment System

The Bill & Melinda Gates Foundation is no stranger to blockchain. Now, they’ve launched Mojaloop, which is an open-source payment platform designed for people who lack access to the usual payment services. Mojaloop’s mobile payment software, built as part of the Level One Project, is powered by the Interledger technology, which in turn was built by distributed ledger technology startup Ripple. In short, Mojaloop wants to link financial institutions, payment providers, and other companies that provide payment services and share information using blockchain. Aside from Ripple, the Gates Foundation also worked with other financial technology companies to make Mojaloop easily accessible. An open application programming interface for mobile systems companies developed by Ericsson, Huawei, Telepin, and Mahindra Comviva will make it easier for mobile money providers to integrate their services with, and build products for, Mojaloop. As the foundation notes, it’s a step at leveling the economic playing field “By crowding in expertise and resources to build inclusive payment models to benefit the world’s poor.”

Source: MIT CSAIL, Mojaloop-Image, Youtube-Image, Linkedin-Image, Rejolut-Image, Futurism

Also Read: